The Impact of AI on Jobs: Are You an Accountant or a Farm Worker?

How supply and demand will determine whether AI automates or advances your job

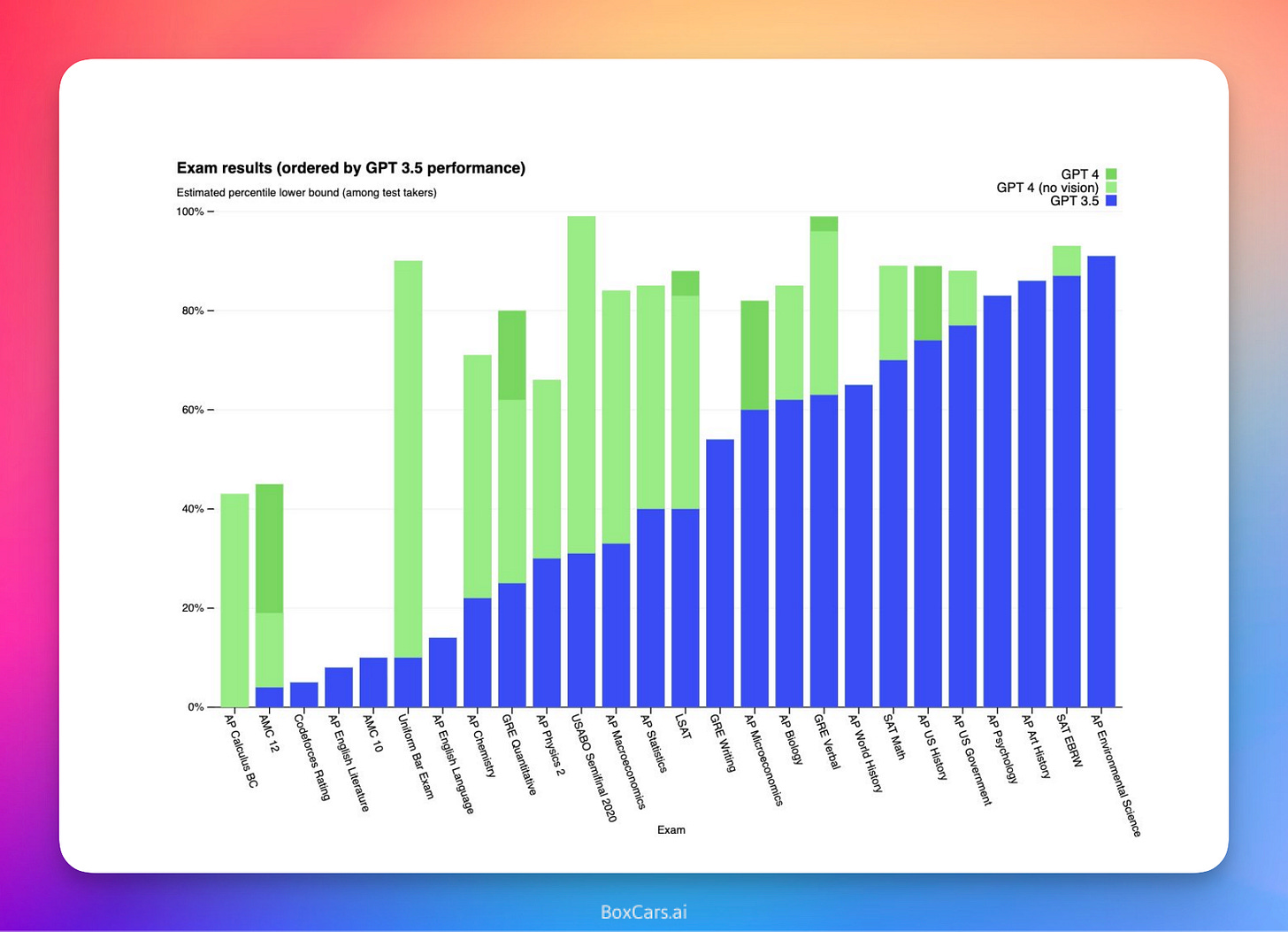

The recent release of GPT-4, an AI language model far more capable than its predecessor GPT-3, has stoked fresh concerns about AI's threat to human jobs. GPT-4 performs better on an array of tests, from the bar exam to advanced science courses, showcasing AI's rapidly advancing power.

A new OpenAI study, 'GPTs are GPTs: An Early Look at the Labor Market Impact Potential of Large Language Models,' examines how AI language models like GPT-4 might impact employment. The research estimates that AI technologies could put nearly 19% of U.S. jobs at risk. The table below shows some of the jobs and the exposure they have to automation by LLMs.

This concern isn't merely theoretical. As startup founder Joe Perkins recently showed in the viral tweet below, GPT-4 can now generate functional code at a cost far below human programmers.

So how might AI affect your employment? As Thomas Puyeo's article 'When will AI take your job?' suggests, the answer comes down to supply and demand. The key effect of technology is increased productivity: we can generate more output at a lower cost. If AI helps you produce your goods or services more efficiently, would that increase demand for it? Or will it tap out

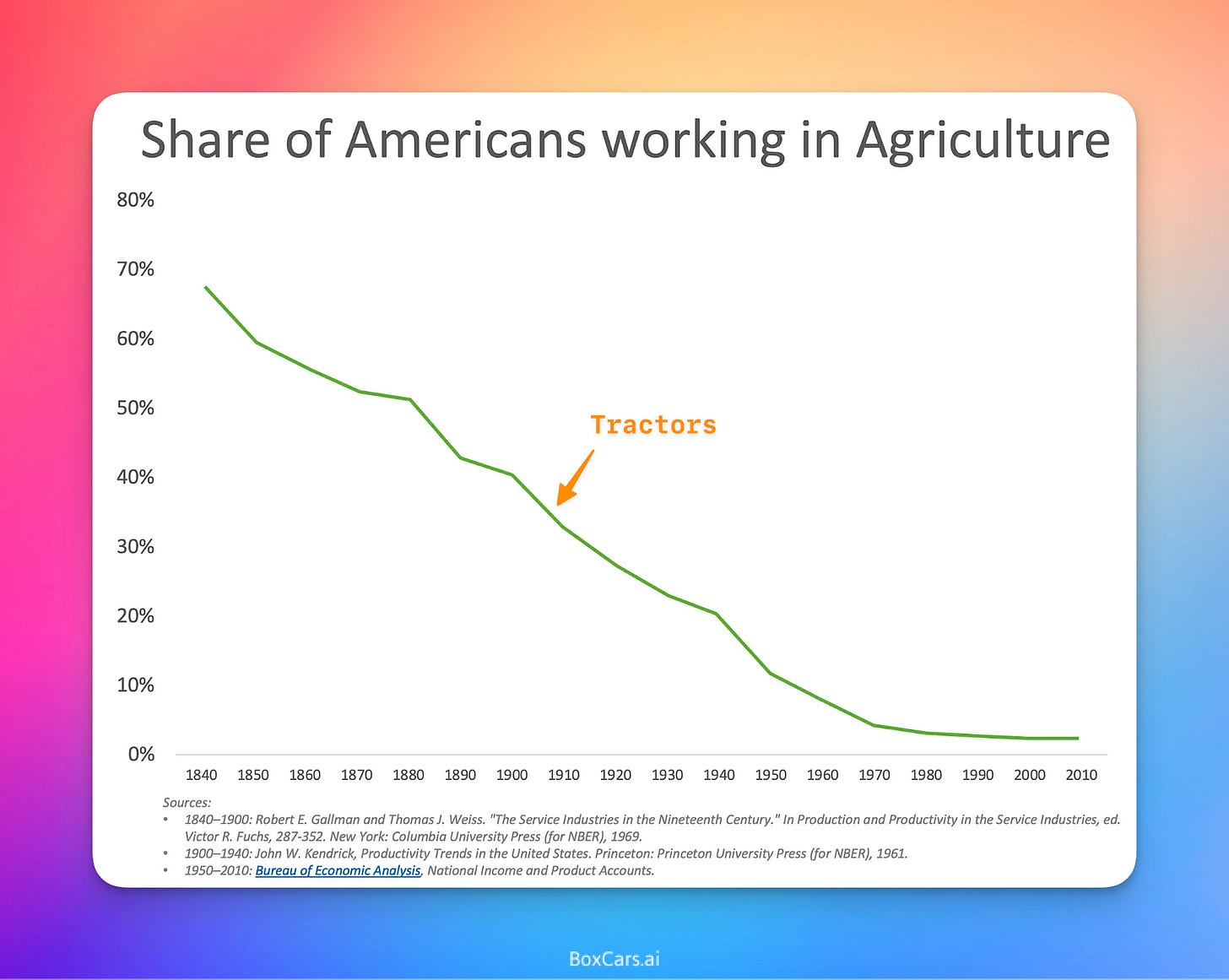

The supply curve below shows the share of Americans working in agriculture plummeting as technologies like gas tractors increased farm productivity. But the demand for agricultural workers has a ceiling—people can only eat so much food.

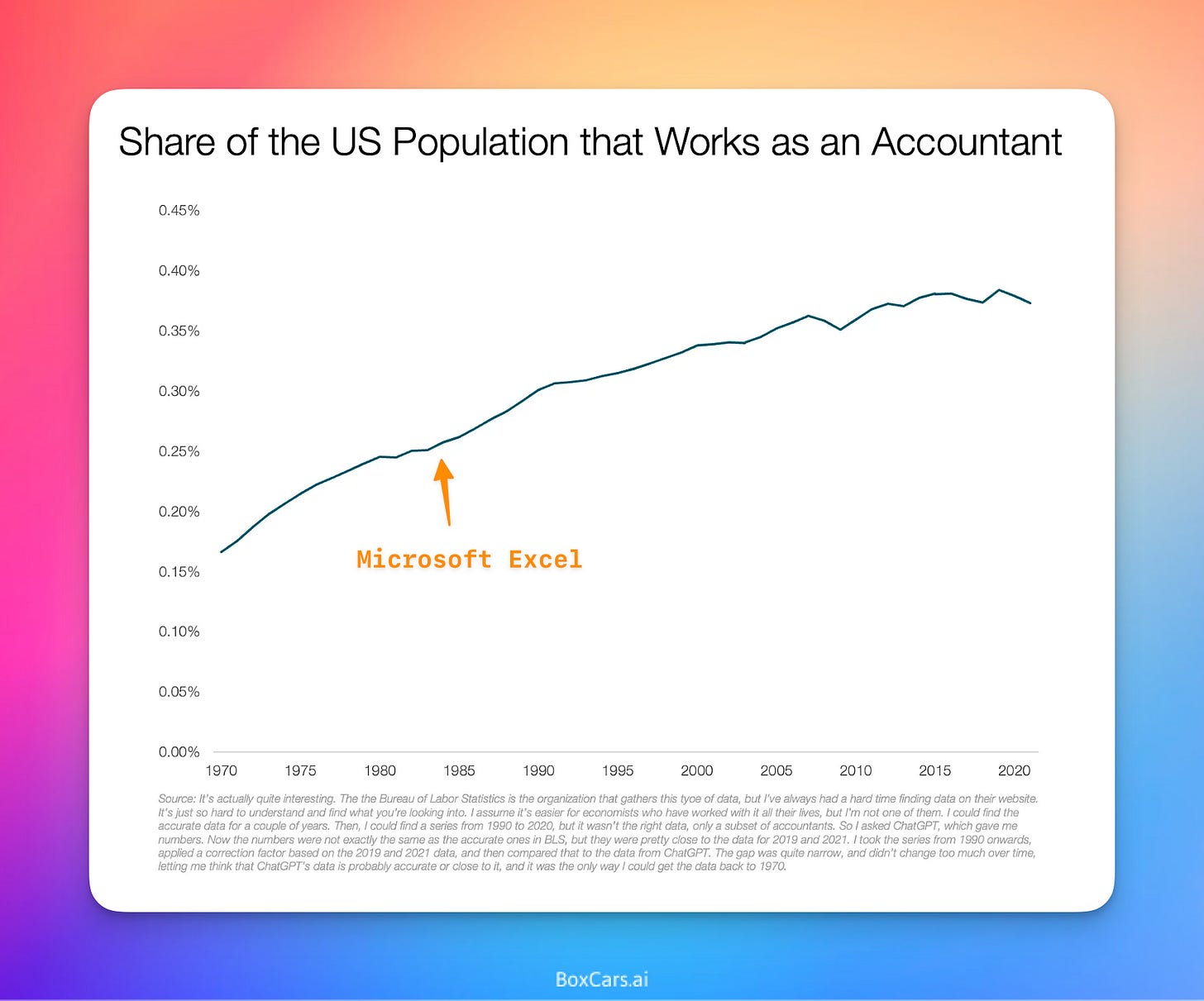

But, here's another graph that illustrates the percentage of the US population working as accountants, which has doubled despite the introduction of technologies such as computers and Microsoft Excel. The increase in productivity has led to a rise in demand for accounting services.

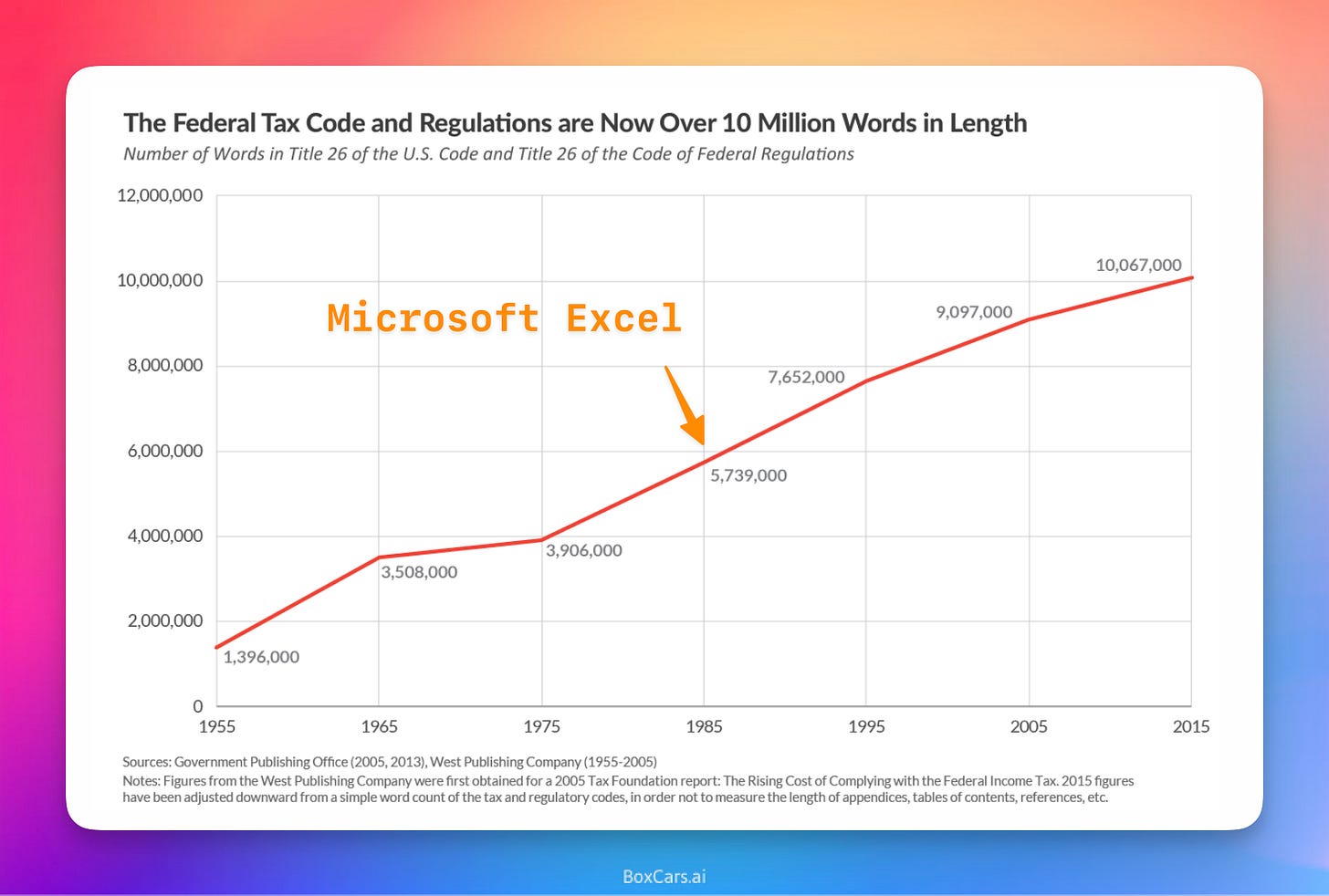

As we’ve gotten better at accounting we’ve started asking for more accounting help. One manifestation of this demand is the size and complexity of the US federal tax code. The chart below from the Tax Foundation shows that the length of the tax code has nearly doubled since Microsoft Excel was introduced.

You can extend this to a variety of professions. For example: As AI systems take on more of the routine legal work currently done by associates and paralegals, it will significantly reduce the cost and time required for many legal services. This could open up the possibility for new deals and transactions to move forward that were previously blocked by legal costs.

So what do you think will happen to your career?