R vs K: What Dinosaurs can Teach Startups About Survival

Mammals adapted post-meteorite, startups must evolve post-LLM. Examining ecological concepts reveals parallels between the aftermath of dinosaurs' extinction and the uncertain business landscape.

It was an extinction-level event unprecedented in Earth's history. Approximately 66 million years ago, a massive meteorite measuring over 6 miles wide struck the Yucatan Peninsula. This single cataclysmic collision triggered a cascade of changes to the planet's climate and ecosystems - alterations so severe that they re-shaped the evolutionary trajectory of life on Earth.

In the aftermath of the impact, the planet was shrouded in a haze of dust and debris that blocked out the sun for years. Average global temperatures plummeted, seasons were disrupted, photosynthesis declined, and the intricate food chains that interlinked disparate species began to collapse. The era of the mighty dinosaurs, which had dominated the planet for over 150 million years, was abruptly ended.

The sudden mass extinction of the formidable dinosaurs at the hands of a meteorite impact raises a puzzling question - how could these seemingly invincible creatures be so vulnerable to a single environmental shift? The answer lies partially in an ecological principle called r/K selection theory, first proposed in the 1960s by researchers Robert MacArthur and E.O. Wilson

The r/K selection theory classifies species based on their reproductive strategies. "r-selected" species produce many offspring and provide minimal parental care. They thrive in unstable environments by playing the numbers game - even if most offspring perish, some will survive by chance. "K-selected" species invest more heavily in fewer offspring to give them competitive advantages. This favors dominance in stable ecosystems but lacks adaptability.

Dinosaurs represented the quintessential K-selected species - they produced a relatively small number of offspring and invested significant parental care to nurture each one. This approach favors dominance in a stable, resource-rich environment where competition is fierce. However, it lacks the resilience required to endure sudden ecological changes.

In contrast, small mammals and other survivors of the mass extinction embodied r-selected traits. They employed a "fail fast, fail cheap" strategy - reproducing rapidly and having many offspring but providing minimal parental investment. While less optimized for dominance, this approach amplifies the odds that at least some progeny will endure unpredictable shifts.

The meteorite impact created initial conditions favoring r-selection. As the rigid, regimented dinosaur ecosystems collapsed, small fuzzy mammals armed with adaptable r-selected traits flourished in the chaotic new world.

Just as the meteorite radically altered the evolutionary landscape, the advent of large language models (LLMs) has triggered a similarly disruptive change in the technology ecosystem. In this new post-LLM environment, investors and startups find themselves needing to choose approaches to deploy capital and build companies.

Yet even amidst the turmoil, we may be in a metastable environment. While the broader tech industry is still undergoing change, pockets of stability remain. In these stabilized niches, pursuing a K-selected strategy focused on optimizing a specialized solution could enable startups to establish dominance firmly.

K-Selection: Specializing to Dominate

Some investors, like Sequoia and Benchmark, epitomize this tactic, making around 30-40 deals per year but investing sizable effort into each. The rationale is that in a world where foundational AI models are becoming the new CPUs of computation, the startups that will rule the roost are those that win out in building cutting-edge architectures tailored to a particular domain.

For example, companies like OpenAI ($11 billion funding), Anthropic ($1 billion funding), and Inflection ($1.5 billion funding) have all raised large rounds to create powerful general-purpose models.

Others are pursuing K-selection by honing in on specialty verticals. Startups like Harvey ($26 million funding) are focused exclusively on the legal space, building AI models attuned to nuances and use cases in that industry. Hippocratic AI ($50 million funding) is similarly specializing to dominate medicine through AI tailored for healthcare.

The returns on creating a leading model in a sector could be immense, given Winner-Take-Most dynamics. However, the risks are also high, as specialized development demands significant capital without a guaranteed payoff. Moreover, the emergence of capable open-source LLMs like LLaMA 2 from Meta calls into question the value of proprietary models. If powerful technologies like LLaMA can be freely adopted and built upon, this could undermine the rationale behind massive investments in closed-source architectures.

r-selection: Generalizing to Find Opportunity

While some investors are making concentrated bets on specialized AI models, others are pursuing an r-selected strategy of spraying across a wide portfolio to back startups applying large language models to a broad diversity of use cases.

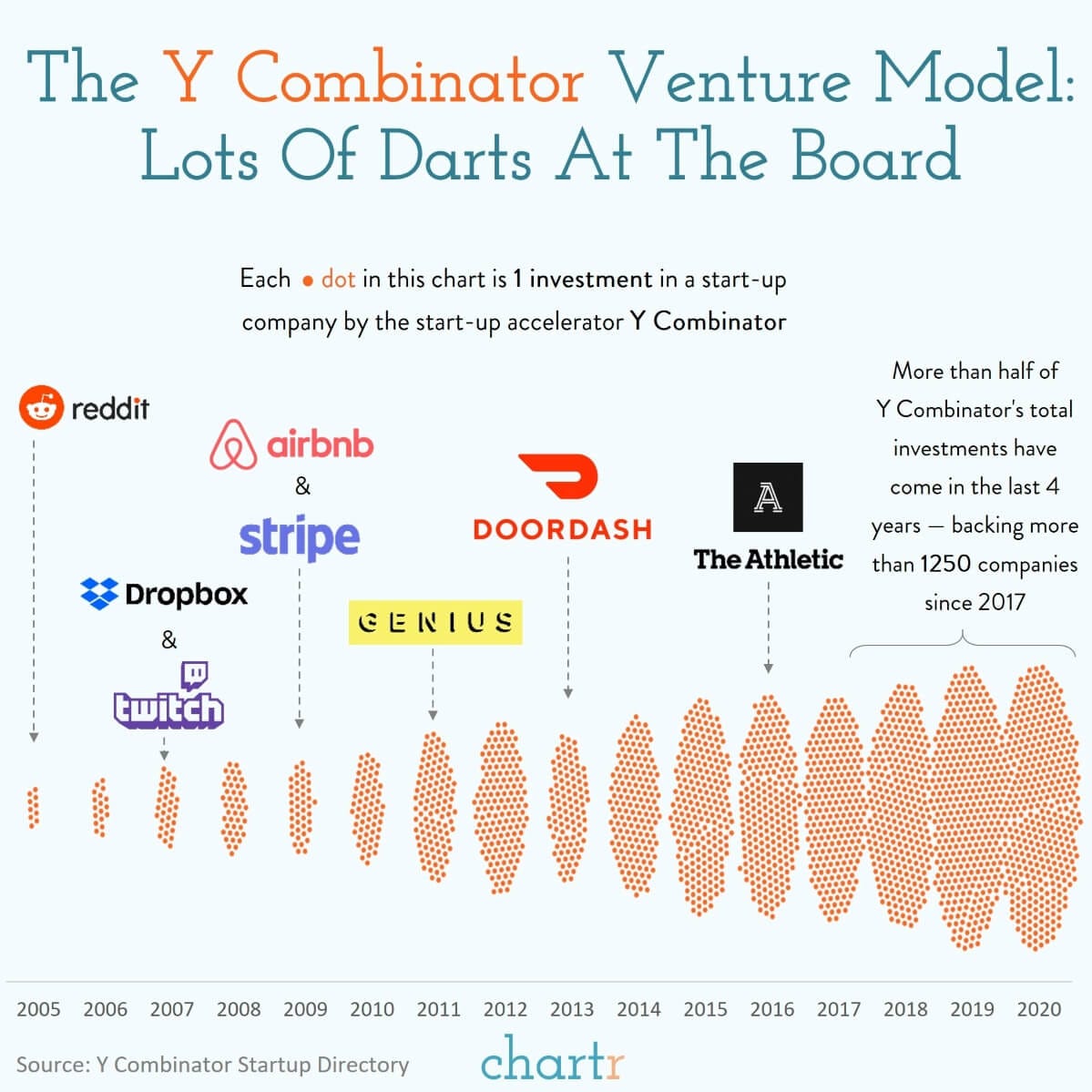

The rationale is that the transformational impact of LLMs will not be uniform across industries. If LLMs are the new CPUs, the "killer apps" built on top of them will ultimately drive adoption. Y Combinator epitomizes this approach, funding over 650 companies across 2 batches in 2022 alone.

With such a wide funnel, the goal is to maximize the chances that a few startups find the right product-market fit before incumbents catch on. However, the perils of this approach are also clear - established players often absorb innovations into their own product stacks before startups can gain distribution.

For example, generative AI startup Jasper garnered over $100 million in funding in 2022 to bring LLM capabilities to marketing use cases. But legacy marketing platforms like HubSpot rapidly introduced their own AI features. Just 9 months after its funding announcement, Jasper had to lay off staff and focus on specialization.

While the risks are high, r-selection allows investors to run many experiments across domains and business models simultaneously. In contrast to finding a single optimized niche, the aim is to uncover many pockets of unmet needs before larger players dominate. It’s an odds game that could reap big returns if even a fraction of the darts hit bullseyes.

The Yin and Yang of Adaptation

As with most dichotomies, the division between r-selection and K-selection is not absolute - it is a spectrum rather than a strict divide. Species exhibit both strategies to varying degrees, adopting different positions along the continuum based on environmental pressures. The mighty dinosaurs had enormous size yet rapid growth rates. Tiny rodents have short lifespans but still nurture their young. The interplay between organism and environment is fluid and dynamic rather than fixed.

Similarly, technology startups employ blended strategies that combine focused optimization with broad experimentation. The meteorite triggered mass extinction, yet dinosaurs' lineages evolved into the agile birds that populate our skies. Just as life endures by adapting to upheavals, so too does creative destruction fuel the startup ecosystem's ongoing vitality in periods of change.

Shifting environmental forces shape and reshape the evolutionary landscape over the eons. Likewise, economic factors mold and remold business models and strategies across market cycles. By studying nature's resilience in the face of external shocks, we gain perspective on navigating technological revolutions. Past cataclysms gave rise to humanity's mammalian ancestors, just as today's disruptions incubate the innovations of tomorrow. While extinctions ruthlessly end the reign of even mighty dynasties, life's dynamism offers the promise of rebirth.

PS: if you’re a founder or an employee of a startup, you are K-selected!

Related Post