Pondering the Future of Search: Why Google Will Win (Part 1)

An analysis of why Google's massive infrastructure, data advantage, and methodical AI integration suggest they'll maintain search dominance in the AI era - and why that might be completely wrong.

In February 2023, Microsoft CEO Satya Nadella threw down the gauntlet. Fresh from a $10 billion investment in OpenAI, he challenged the tech world's most entrenched player - Google.

"It's a new race in the largest software category - search," Nadella declared, taunting Google to "come out and show they can dance."

Eighteen months later, as the dust settles on those initial skirmishes, I find myself torn between two competing visions of search's future. Over the next two weeks, I'll explore both sides of this debate.

Today's perspective is deceptively simple: Google will absorb AI search just like it absorbed every other "revolutionary" feature. The evidence is compelling - despite Nadella's challenge, Google's market share remains virtually unchanged. The graveyard of Google challengers is vast, and Microsoft's AI gambit might just be the latest headstone.

But next week, I'll argue why this analysis is wrong. Why comparing AI to mobile search misses the point entirely, and why Google's 90% market share might be as relevant as Yahoo's webmail dominance was in 2004.

For now, let's explore why the pragmatists might be right about Google's inevitable victory.

The Numbers Tell a Story of Stability

When Microsoft launched AI-powered Bing in 2023, they created scarcity through waitlists and browser requirements. Want early access to the future of search? Switch to Edge browser. Need AI-powered answers? Join the Bing waitlist. It was a textbook rollout strategy - use exclusive features to drive adoption.

The results? Let's look at the numbers.

In February 2023, Bing held 2.97% of the search market, with Google commanding 92%. Fast forward to November 2024, and after billions in investment, countless headlines, and genuine technical innovation, Bing has moved to... 3.82%. Google sits at 90.48%.

The browser wars tell a similar story. Microsoft Edge, despite being the default on Windows and the gateway to AI search, moved from 4.28% to 4.75% market share. Chrome? Still dominates at 66%.

Even when we look at standalone AI assistants, the numbers are revealing. Google's Gemini averages 274M monthly visits. OpenAI boasts "200M weekly ChatGPT users" - an oddly specific metric that suggests their monthly numbers might not be as impressive as 4 x 200M.

Other players like Perplexity (15M users) and Claude (70M monthly visits) are innovative but remain relatively small. Meanwhile, Google processes 8.5 billion searches daily. Or 3.1 trillion searches annually.

The scale difference is staggering. While AI assistants measure success in millions of users, Google's search empire operates in billions. And after 18 months of the AI search revolution, those billions haven't budged.

Google's Methodical AI Integration

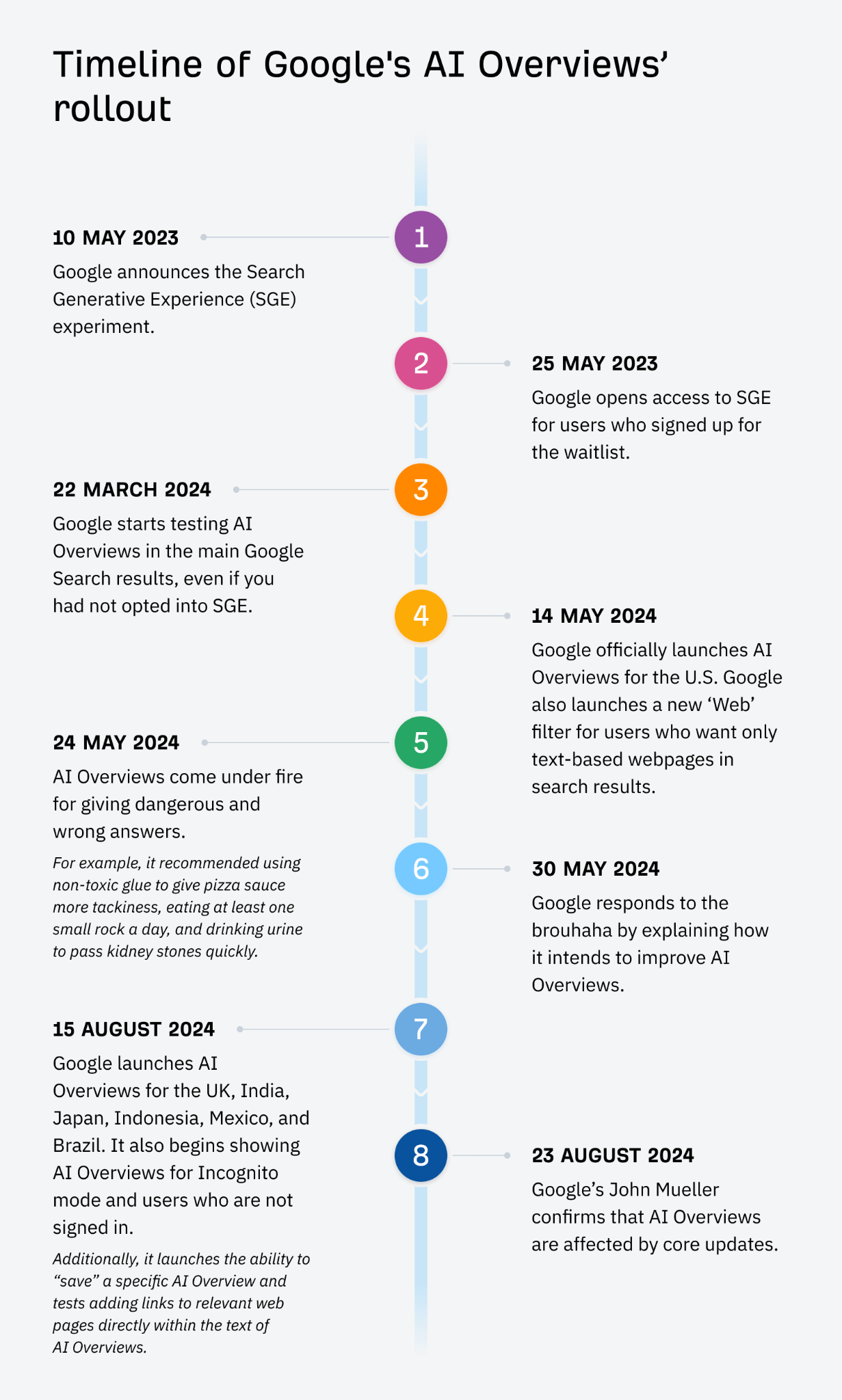

While tech headlines screamed revolution, Google executed evolution. Their initial AI search offering, Search Generative Experience (SGE), was rebranded, refined, and relaunched as AI Overviews. In May 2024, AI Overview came under fire for giving dangerous advice and wrong answers. For example, it recommended using non-toxic glue to give pizza sauce more tackiness and eating at least one small rock a day. But Google didn't retreat. It continued working on AI Overviews and By late October 2024, they had expanded to over 100 countries, bringing AI-enhanced search to more than a billion monthly users. For a company that many said had missed the LLM boat they had re-entered the arena.

But the real story isn't just about feature rollout - it's about monetization. In October, Google launched AI Overview Ads, seamlessly integrating their advertising engine with AI responses. This matters because Google's advertising machine is staggering: projected 2024 ad revenue of $77 billion in the US alone ($187 billion worldwide), generating $411 per search user.

From Google's perspective, AI search is an upgrade to the search we know and love. Just as mobile search became another format for delivering ads, AI Overviews are becoming another surface for Google's core business model. Their millions of existing advertisers, already comfortable with intent-based advertising, can simply extend their campaigns into this new format.

The math is compelling: Google's massive ad revenue can easily subsidize free AI features while maintaining profitability. While competitors struggle to monetize standalone AI assistants, Google is methodically connecting AI capabilities to their existing cash-printing machine.

Why Google Maintains Its Lead

Distribution: The Power of Default

Google's dominance isn't just about search quality - it's about being everywhere. The recent US antitrust case revealed that Google pays $26.3 billion annually just to remain the default search engine across platforms. Apple alone receives between $18-20 billion to keep Google as the default on Safari, while Mozilla's Firefox and other browsers split the remainder.

But Google doesn't rely solely on paying for placement. They've spent 16 years and billions developing Chrome, which now commands 66% of the global browser market. From Android phones to Google Home devices, they've built an ecosystem where Google search isn't just the default - it's seamlessly integrated into daily digital life.

The Compute and Data Advantage

Three key factors drive AI capabilities: data, compute power, and model size. Google excels at all. Their infrastructure advantage is staggering - data centers across 23 regions and 70 zones globally process over 3.1 trillion searches yearly, all running on custom-built hardware. Their infrastructure is so vast they've had to invent new ways to manage it - MapReduce, originally developed for Google's internal use, spawned an entire industry of big data tools.

At its core, Google's first and most sophisticated data collection system remains its search crawler. Googlebot continuously crawls the web, instantly parsing broken HTML, highly interactive websites, and complex web applications. The resulting index contains over 400 billion documents, consuming 100 million gigabytes of storage - a digital library that dwarfs anything in human history.

But web crawling is just the beginning. Google's real strength lies in their unmatched data collection systems. Remember when Google needed to digitize books, they didn't just hire people - they invented custom scanning hardware to process millions of volumes. When they wanted to map the world, they strapped custom cameras to cars and backpacks to photograph every street and trail they could find.

The scale of their data collection is mind-boggling. Gmail serves 1.8 billion users who send 121 billion emails daily. Google Photos stores 13 petabytes of images, enhanced with 2 trillion user-generated tags. This massive data advantage isn't just about quantity - it's about variety and quality. While competitors might have access to public web data, Google has two decades of refined search queries, user behaviors, and cross-platform interactions. For training AI models, this diverse, high-quality data is invaluable.

History Rhymes: The Netscape Echo

Today's AI battle echoes a moment from the early internet era. In 1995, Netscape dominated the nascent web browser market. Founded by Silicon Graphics veteran Jim Clark and wunderkind Marc Andreessen, Netscape captured 80% of the browser market and executed the most successful IPO of its time. They were the future of the internet, until they weren't.

Microsoft, seeing the browser as a threat to Windows, responded by bundling Internet Explorer with their operating system. The strategy was devastatingly effective - users didn't need to download or install anything; the browser was just there. By 1999, Netscape's market share had plummeted to 10%. Despite having superior technology and first-mover advantage, Netscape couldn't overcome Microsoft's distribution power.

Today's AI landscape feels eerily similar. OpenAI, another company of brilliant innovators, launched ChatGPT to massive acclaim. Microsoft, once again, moved quickly to integrate AI into their products. But this time, Google isn't playing Netscape's role.

When Microsoft CEO Satya Nadella suggested Google was "dancing to our music" in the AI race, Google's CEO Sundar Pichai responded confidently that Google "dances to its own music." The metaphor is apt. Unlike Netscape, Google controls its own distribution destiny through Chrome, Android, and billions in default search agreements. They have the data, the compute power, and most importantly, a clear path to monetization through their advertising platform.

The rhythm of this particular historical rhyme suggests a different ending. While Netscape relied solely on browser downloads, Google has spent two decades building an impressive distribution network. They're not fighting for installation; they're already installed. They're not seeking monetization; they're already printing money. And they're not racing to catch up; they're methodically integrating AI into the world's most successful internet business.

This time, the incumbency advantage belongs to Google.

But this analysis might be missing something fundamental. What if, instead of AI being just another feature of search, search becomes merely a feature of AI? From Microsoft's recall feature to emerging AI interfaces, the tech industry isn't just adding AI to existing tools - it's remaking the entire computing platform around AI. Next week, we'll explore why Google's dominance in search might matter less in a world where search isn't the primary way we interact with information. Subscribe here to get that analysis directly in your inbox.