From Bolt-on to Built-in: How AI-Native Apps Could Evolve - A Buffer Case Study

Exploring the challenges and opportunities for B2B SaaS companies as they navigate the AI revolution.

How long did it take the GenAI market to reach $3 billion in revenue? One year. How long did it take the SaaS market? Ten years. Sequoia Capital's Sonya Huang highlighted this fact in her 2024 "The AI Opportunity" presentation. Sequoia Capital, the venture firm behind tech giants like Apple, Google, and Airbnb, isn't just taking notice—they're betting big on GenAI's potential to reshape entire industries.

This rapid growth underscores the potential of GenAI in the B2B SaaS landscape. As vendors rush to incorporate AI features into their existing platforms, we're witnessing a rapid pace of Gen AI adoption.

However, the impact of GenAI on SaaS companies isn't simply additive. It's not just about tacking on a new feature tier for extra revenue. Instead, the arrival of GenAI has the potential to remake the core job-to-be-done for many products. This shift will affect companies in different ways, potentially reshaping business models and value propositions.

To explore how B2B SaaS companies are navigating this AI wave, we'll focus on one company in this article: Buffer. Known for its radical transparency - sharing everything from company metrics to employee salaries - Buffer offers us a unique window into how a successful B2B SaaS company is adapting to this new AI-driven landscape.

By examining Buffer's approach, we can uncover the challenges, opportunities, and strategic decisions that B2B SaaS companies face as they integrate AI capabilities.

Buffer: Streamlining Social Media Since 2010

In the fast-paced world of social media, timing is everything. This simple insight led to the birth of Buffer, a popular social media management tool that helps individuals and businesses manage their online presence.

Buffer's journey began in November 2010 as a Startup Sprint project. Founder and CEO Joel Gascoigne was grappling with a common problem faced by social media enthusiasts and marketers alike: how to space out tweets for optimal engagement. This personal pain point became the catalyst for a solution that would serve millions.

By 2013, just three years after its inception, the platform had already amassed an impressive 1 million registered users. The company's growth continued, and by 2015, Buffer hit $10 million in annual recurring revenue.

Buffer operates on a freemium model, offering both free and paid tiers to cater to a diverse range of users. As of February 2020, Buffer's annual revenues were $22 million, and its user base comprised 156K free users and 39K paid users.

Buffer's Evolution in Social Media Management

In the early days of social media marketing, Buffer identified a singular pain point: the need to schedule tweets. This simple feature became Buffer's wedge into social media management. But as any social media manager knows, scheduling is just one piece of a larger workflow.

Social Media Managers have to:

Ideate: Brainstorm content ideas that resonate with the audience

Create: Craft compelling posts, including text and visuals

Analyze: Measure the performance of content and strategy

Engage: Interact with followers and build community

Following the trajectory of many point SaaS solutions, Buffer expanded its product footprint to encompass the entire workflow. They introduced an inbox for capturing ideas, Pablo for visual content creation, analytics for performance measurement, and engagement features for audience interaction. This evolution transformed Buffer from a simple scheduling tool into a comprehensive social media management platform.

Buffer's approach mirrors the typical SaaS company playbook. Software's strength lies in automating and managing workflows, and Buffer's product accomplishes this with simplicity and efficiency. However, zooming out reveals that workflow management is just one facet of a social media manager's job. Just like managing the pipeline in a CRM is just one part of a salesperson's work. The real challenge, where most effort is expended, lies in ideating, writing, re-writing, and editing content (or in the case of sales, identifying paint points and value propositions for prospects). These tasks were largely beyond the reach of traditional software, firmly in the domain of human creativity and effort. Software's role was to enhance efficiency, not to perform these core functions.

It's into this landscape that Generative AI has erupted, promising a shift. Software is no longer content with merely tracking and organizing work; it now aspires to do the job itself.

How GenAI Can Actually Do Work

The release of GPT-3 APIs in 2020 marked a pivotal moment in the evolution of AI-powered tools. For the first time, software could not only manage workflows but also generate high-quality text content with minimal human input. Companies like CopyAI and Jasper quickly capitalized on this breakthrough, offering tools that could produce actual social media posts, tackling a part of the workflow previously thought to be the exclusive domain of human creativity.

To use an analogy, traditional social media tools were like hammers and nails, helping you hang up your pictures. With the advent of GenAI, these tools now had the potential to come with the pictures included.

Sarah Tavel, General Partner at the respected VC firm Benchmark, explained this paradigm shift in her 2023 blog post "AI startups: Sell work, not software": (emphasis is mine)

"For the past 25 years, application software startups have had a singular focus: increasing company and employee productivity.

... More often than not, this software has been priced on a per seat basis, in essence benchmarked against the cost of the headcount itself and increasing that headcount's productivity.

... LLMs create an opportunity for startups to look beyond this way of thinking and discover surface area that previously was out of bounds for selling software

... To do this, rather than sell software to improve an end-user's productivity, founders should consider what it would look like to sell the work itself."

The market response to this new approach was overwhelmingly positive. Jasper, for instance, achieved $1M ARR within just three months of launch and hit $10M ARR within six months, demonstrating the enormous appetite for AI tools that do work.

However, not everyone was immediately convinced of the transformative potential of GenAI. In May 2022, Buffer addressed the topic in their company blog post "Ask Buffer: Should You Be Using AI for Content Creation?" Their approach was one of curiosity mixed with skepticism, viewing these GenAI tools primarily as enhanced word processors to be used in the ideation part of the workflow:

"If you're curious about what AI can contribute to your marketing, consider CopyAI's extensive options or Copysmith (the only tool to get a 4/5 star rating in this Writer article). The tool focuses on marketing for e-commerce teams and agencies but has several interesting use cases, including product descriptions, blog templates (not the whole thing), and ad copy.

And when you have your copy ready, at least for social media, you can publish it through Buffer 😉."

This cautious stance was soon to be challenged. Just six months later, OpenAI introduced ChatGPT to the world, catapulting GenAI from a niche experiment for early adopters to a mainstream phenomenon. The potential of AI to not just assist in content creation, but to generate high-quality, contextually relevant content at scale, became apparent to everyone almost overnight.

This rapid shift in perception and capabilities set the stage for a reimagining of what software could do. The question was no longer whether AI could contribute to these tasks, but how deeply it would transform the entire landscape of digital marketing and content creation.

Buffer's Swift Response to the AI Revolution

The launch of ChatGPT in November 2022 marked a watershed moment in the tech industry. Becoming the fastest-growing app in history, it amassed an astounding 100 million users within just two months of its release. This rapid adoption underscored the immense potential and public interest in generative AI technologies.

In the fast-paced world of SaaS, where API-driven architectures and modern web development practices reign supreme, the integration of AI capabilities into existing platforms became not just possible, but imperative. Social media management companies, including Buffer, recognized the need to adapt quickly to this new paradigm.

Buffer wasn't alone in this AI arms race. The first half of 2023 saw a flurry of activity as major players in the social media management space rushed to integrate AI capabilities:

Hootsuite OwlyWriter AI: April 2023

Sprout Social AI: April 2023

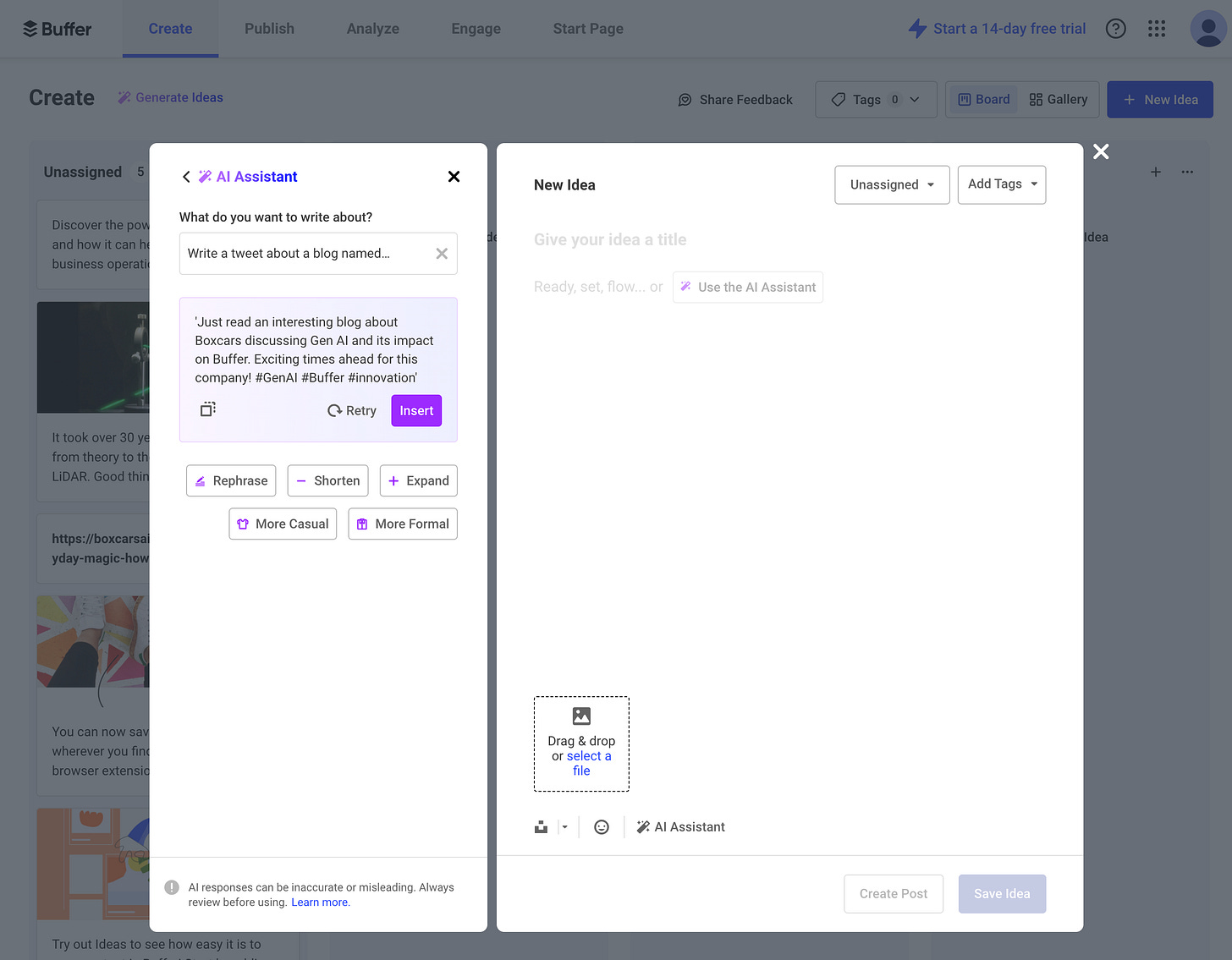

Buffer AI Assistant: May 2023

Sprinklr AI+: May 2023

In a bold move, Buffer offered unlimited access to the AI assistant across all subscription tiers. Buffer's expenses for its AI assistant are linked to OpenAI's pricing structure.

In the spring of 2023, OpenAI charged approximately $0.002 per 1,000 tokens for its GPT-3.5 model, with a token roughly equivalent to 3/4 of a word in English.

A conservative estimate, assuming 10% of Buffer's 150,000 monthly active users use the AI once a month with 500 tokens per use, would result in a monthly cost of around $15. A more aggressive scenario, where 35% of users leverage the AI 10 times a month with 1000 tokens per use, could see Buffer's monthly expenses rise to approximately $1,050.

Related:

These costs pale compared to the potential value added to Buffer's service and the competitive edge maintained by offering cutting-edge AI capabilities.

The Next Phase: Redefining Software's Job to Be Done

The initial rush to integrate AI into every product and landing page has subsided. However, as the dust settles, we're beginning to see that the current AI implementations are just the tip of the iceberg. As Elad Gil, a technology entrepreneur and investor, aptly puts it:

"It takes time to think AI-native. The first-pass product is often a bolt-on or simple chat experience. The high-value experience is a deeper rethink once you have played with the technology, understood what it really provides more deeply, and then integrated it into a key part of your product experience."

Buffer and other social media management providers' current AI implementations are early iterations - essentially bolt-ons to existing workflows. In theory, users could achieve similar or potentially better results using AI-enabled web browsers like Edge or ChatGPT extensions in Chrome with their own prompts and LLMs within Buffer's interface.

So, what would an AI-native solution for Buffer or other social media apps look like? Drawing inspiration from Sarah Tavel's 'Sell Work' principle, here are some thoughts:

Do the Job, Not Just Track the Work

The new paradigm involves thinking of AI as a junior employee or intern bundled into the system, capable of taking on complex tasks that are easy to supervise. Examples of this approach are already emerging in other industries:

Cocounsel by Thomson Reuters: Originally a company called Casetext, Thomson Reuters has integrated this AI capability with its extensive legal dataset. Lawyers can now ask Cocounsel to draft actual work products for review, mimicking the role of an associate lawyer.

GitHub Copilot Workspace: Currently in technical preview, this is GitHub (Microsoft)'s approach to an AI-native development environment. Developers write task specifications, review the AI's plan, provide feedback, and then review the AI-produced code. The AI generates a Pull Request, seamlessly integrating into existing workflows.

Leverage a Data or Workflow Moat

In its current form, Buffer's AI assistant offers little advantage over using Edge Copilot within the Buffer interface. Users can easily switch between these tools with minimal friction, as the AI's context primarily comes from user input. This stands in stark contrast to the deep integration seen in GitHub's Copilot, which directly accesses a user's code repository. GitHub Copilot doesn't merely assist; it becomes an integral part of the development workflow, leveraging the vast context of the entire codebase. This level of integration is what Buffer and other SaaS companies should strive for in creating truly AI-native solutions.

Buffer's potential lies in its access to valuable user data, including tweet history and performance metrics. An AI-native Buffer could harness this data to offer highly personalized content suggestions, determine optimal posting times, and craft engagement strategies tailored to each user's unique audience. This evolution would transform Buffer from a task tracker that improves efficiency to a co-worker that produces outcomes.

However, the path from Buffer's current AI implementation to this AI-native future is not without its challenges. As an established company with existing products and customers, Buffer faces the classic innovator's dilemma: how to innovate radically while maintaining and improving their current offerings.

With $3M in the bank and a product & dev team of about 38, Buffer likely already has a packed roadmap of bugs and features. Unlike newer competitors who can build AI-native solutions from scratch, Buffer can't simply allocate new teams to tackle this problem. But Buffer has something the new competitors don't: 150K MAUs, 55K paid customers, and 14 years of data.